Understanding VAT is crucial for success as an Amazon seller. VAT, or Value Added Tax, affects pricing, compliance, and profitability. This guide will walk you through the essentials of VAT, including how to register, charge, and remit VAT on Amazon. By the end, you’ll be equipped to manage your VAT obligations effectively and avoid common pitfalls.

Table of Contents

What is VAT?

VAT (Value Added Tax) is a consumption tax imposed on the value added to goods and services at each stage of production or distribution. Unlike income tax, which is collected on the income of individuals or businesses, VAT is collected incrementally from the point of manufacture to the point of sale.

In practical terms, when an Amazon seller sells a product, VAT is included in the price the customer pays. The seller must then remit this tax to the government, usually on a monthly or quarterly basis, depending on the regulations of the country in which they operate.

The way VAT is calculated is fairly straightforward. Each seller in the supply chain charges VAT on their sales (output tax) and pays VAT on their purchases (input tax). The difference between the output tax and the input tax is the amount that is due to the tax authorities.

To comply with VAT regulations, Amazon sellers must register for a VAT number in each country where they are required to collect VAT. This enables them to collect VAT from customers and remit it to the tax authorities. Failure to comply with VAT rules can result in hefty fines and legal complications.

It’s important for Amazon sellers to keep accurate records of all sales and purchases to ensure they are correctly calculating and remitting the VAT owed. This includes keeping invoices, receipts, and any other relevant documents.

Why VAT is Important for Amazon Sellers

Why VAT is Important for Amazon Sellers

Value-Added Tax (VAT) plays a crucial role in the financial and legal landscape for Amazon sellers. It’s not just a tax obligation; it can also have significant business implications.

Legal Compliance: Complying with VAT regulations is essential to avoid legal penalties and fines. Governments require sellers to collect and remit VAT on eligible transactions.

Market Trust: Proper VAT adherence builds trust with both customers and suppliers. It signifies that your business is legitimate and operates transparently.

Financial Health: VAT impacts your pricing strategy and profit margins. Understanding how VAT affects your product pricing can help you stay competitive while adhering to tax obligations.

Cross-Border Expansion: For Amazon sellers looking to expand into international markets, understanding and managing VAT is critical. Different countries have varying VAT rates and regulations, making it essential to stay informed.

Operational Efficiency: Integrating VAT compliance into your business processes can streamline operations. Automated VAT calculation and reporting tools can save time and reduce errors.

Overall, managing VAT effectively helps Amazon sellers avoid legal issues, maintain financial health, and build credibility in the marketplace.

How to Register for VAT

To begin the VAT registration process, you must first determine the specific requirements of the country in which you are registering. Each country within the EU has its own set of rules and procedures, so thorough research is essential.

Step 1: Gather Required Information

Compile all necessary business information, including your business name, address, and type of business activities. You may also need your tax identification number and bank account details.

Step 2: Choose Your Registration Method

You can generally register for VAT online via the relevant government portal. Registration forms can vary by country, so ensure you complete the correct form for your business type.

Step 3: Submit Your Application

Once you have completed the registration form, submit it along with any required supporting documents. These may include proofs of identity, business registration certificates, and proof of address.

Step 4: Await Your VAT Number

After submission, you will receive a confirmation from the tax authority. Processing times can vary, so be prepared for a wait of a few weeks. Once your application is approved, you will receive your unique VAT number, which you are required to display on your invoices and other business documents.

Step 5: Understand Your Reporting Obligations

Upon receiving your VAT number, familiarize yourself with the VAT reporting requirements and deadlines. These requirements can include filing periodic VAT returns and maintaining accurate records of all taxable transactions.

Step 6: Adjust Your Pricing

Make sure to adjust your product prices to include VAT, ensuring that your customers are aware of the tax implications at the point of sale.

By following these steps, you can effectively register for VAT and ensure compliance with local tax laws.

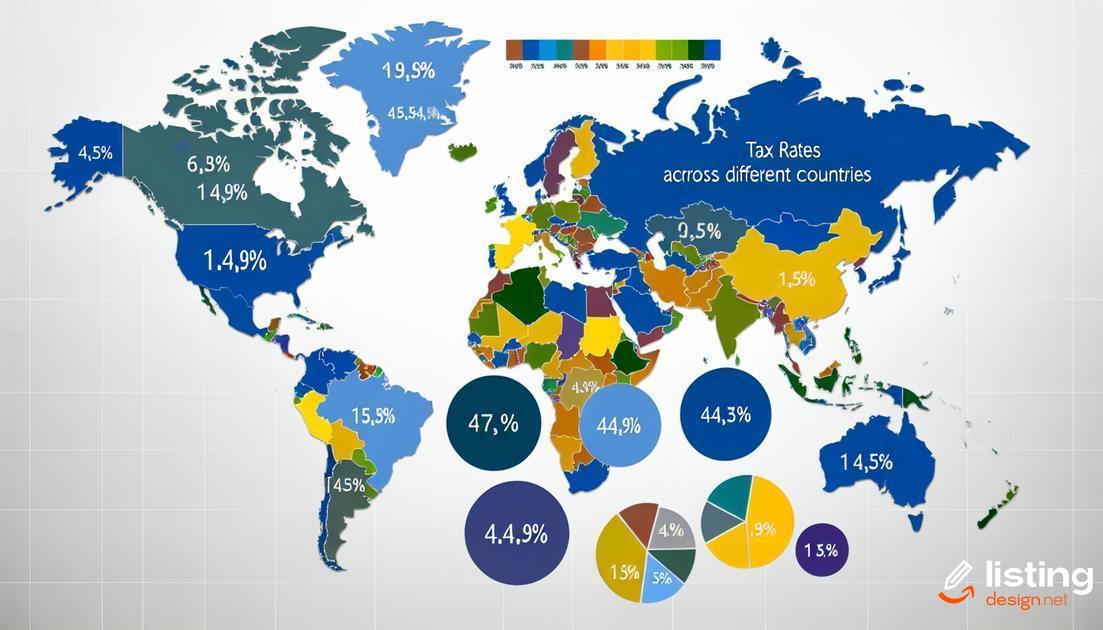

VAT Rates Across Different Countries

When it comes to VAT (Value Added Tax), rates can vary significantly from one country to another. For Amazon sellers, understanding these differences is crucial to ensure compliance and optimize pricing strategies.

European Union (EU)

The European Union has a harmonized VAT system, but each member country sets its own rates. For example, Germany has a standard rate of 19%, while Italy’s stands at 22%. Most countries also have reduced rates for specific goods and services, such as food and children’s clothing.

United Kingdom (UK)

Following Brexit, the UK has its own VAT regulations, with a standard rate of 20% and reduced rates for certain items.

United States

The United States does not have a federal VAT system, but some states have sales tax which can often function similarly. The rates and rules vary widely across states.

Canada

Canada employs a GST (Goods and Services Tax) at a federal level, with some provinces adding a PST (Provincial Sales Tax) or a combined HST (Harmonized Sales Tax). Rates fluctuate based on provincial regulations but generally average around 13-15% for the HST.

Australia

Australia applies a 10% GST across all goods and services sold within the country. Specific exemptions apply for certain essential goods like food and healthcare services.

Japan

Japan has a standard VAT rate of 10%, with a reduced rate of 8% for specific items, including food and beverages (excluding alcohol).

Other Countries

Many other nations have their own VAT systems with varying rates. For example, India’s GST rates range from 0% to 28%, making it essential for sellers to be aware of these rates to ensure accurate pricing and compliance.

In conclusion, staying updated on VAT rates across different countries is critical for Amazon sellers aiming for global market penetration.

How to Charge VAT on Amazon

Charging VAT on Amazon

Charging VAT on Amazon is essential for compliance and ensuring that your business operates smoothly. Here’s how you can effectively charge VAT:

1. Understand Your Tax Obligations

Before you start charging VAT, you need to understand your tax obligations in the countries you are selling. Each country has its own VAT rates and rules.

2. Configure VAT Settings in Amazon Seller Central

Amazon provides tools for sellers to manage VAT. Navigate to the VAT Calculation Services in Seller Central and configure your VAT settings. Ensure you correctly input your VAT registration numbers for the countries where you are obligated to charge VAT.

3. Set Product Tax Codes

Assign the appropriate product tax codes to each of your listings. These codes determine the VAT rate applied to your products based on the tax rules in each country.

4. Display VAT-Inclusive Prices

Ensure that the prices displayed to customers include VAT. This helps prevent any confusion and builds trust with the buyers.

5. Issue VAT Invoices

Provide VAT invoices to your customers. These invoices should include your VAT number, the VAT rate applied, and the total VAT amount charged. This is crucial for transparency and compliance.

6. Monitor and Adjust

Regularly monitor your VAT settings and make adjustments as needed. VAT rates and regulations can change, so staying updated will help maintain compliance.

By following these steps, you ensure that your VAT charging process is seamless and compliant with the regulations of different countries.

Collecting and Remitting VAT

When selling on Amazon, collecting and remitting VAT is essential for compliance and avoiding penalties. Sellers must ensure they are charging the correct VAT rate on their products based on the destination country of the buyer. This process involves understanding and applying different VAT rates, which can vary significantly between countries.

After collecting VAT from customers, it is crucial to remit the collected VAT to the appropriate tax authorities. This often includes filing periodic VAT returns, which detail the amount of VAT collected and any VAT paid on business expenses that can be reclaimed.

To simplify this process, many sellers use automated tools or services that integrate with Amazon Seller Central, ensuring that VAT is collected accurately and remitted on time. Consistently managing VAT obligations can help maintain a good standing with tax authorities and prevent disruptions to your Amazon business. Properly documenting all transactions and keeping meticulous records is also vital to support VAT return filings and audits.

Exemptions and Special Cases

Exemptions Based on Seller Status

Certain sellers, such as small businesses with low annual sales, might be eligible for VAT exemptions. These exemptions vary from country to country. For instance, in the EU, if your sales are below a certain annual threshold, you may not need to charge VAT.

Goods and Services Exemptions

Some products and services are exempt from VAT. Common exemptions include educational services, some healthcare products, and financial services. Understanding these exemptions can help you avoid unnecessary VAT charges.

Special Cases for Digital Products

Digital products often have different VAT rules. Countries may have specific VAT rates or exemptions for e-books, software, and digital services. It’s crucial to know such distinctions to properly manage your VAT obligations.

Intracommunity Supplies

For sellers dealing with intracommunity supplies within the EU, VAT is usually not charged if the transaction is between two VAT-registered businesses. Instead, the buyer accounts for VAT under the reverse charge mechanism.

Handling Returns and Refunds

Handling returns and refunds can complicate VAT calculations. Ensure your accounting systems are prepared to adjust VAT on refunded items, whether the return is due to a fault or customer discretion. Proper documentation is essential for accurate VAT remittance.

How Cross-Border Sales Affect VAT

The Impact of Cross-Border Sales on VAT

When selling products across borders, understanding and managing VAT (Value Added Tax) is crucial for maintaining compliance and minimizing financial risks. Each country in the EU has its own specific VAT rates and rules, making it important for Amazon sellers to stay informed and adaptable.

VAT Registration in Multiple Countries

Selling in various countries often necessitates VAT registration in multiple jurisdictions. Depending on where your customers are located, you may be required to register for VAT in each of those countries. This can be a complex process that involves understanding the local VAT laws and keeping up with changing regulations.

For instance, if your sales exceed a certain threshold in a particular country, you must register for VAT there. This is known as the distance selling threshold and varies from country to country. In some cases, the threshold can be quite low, causing sellers to register and comply sooner than expected.

Charging and Reporting VAT

Once registered for VAT in a country, you need to charge the correct VAT rate on your sales to customers in that country. This involves determining the right rate to apply, as different types of products might attract different VAT rates. Additionally, you must accurately report and remit VAT collected to the relevant tax authorities.

It’s important to keep thorough records of your sales and VAT transactions, as this will help you to prove compliance during audits and avoid significant penalties. Using a robust accounting system or VAT software can be beneficial for handling these responsibilities and ensuring accuracy.

VAT Returns and Documentation

Submitting VAT returns is a mandatory requirement for all registered sellers. These returns detail the VAT collected and paid on your sales and purchases. Different countries have varying deadlines and formats for VAT return submission, requiring sellers to stay organized and timely in their reporting.

In addition to periodic VAT returns, you may also need to provide detailed documentation related to your cross-border sales. This includes invoices, shipping records, and proof of delivery, which might be requested by tax authorities during audits.

Challenges and Solutions

Cross-border sales introduce several challenges, including understanding different VAT rates, navigating registration requirements, and meeting filing deadlines. However, these challenges can be mitigated with a proactive approach and effective management tools. Employing specialized VAT software, seeking expert advice, and staying informed about changes in VAT laws are essential strategies for successful cross-border selling on Amazon.

Common VAT Compliance Mistakes

Even seasoned Amazon sellers can make mistakes when it comes to VAT compliance. These errors can have serious financial consequences, so understanding them is crucial for maintaining a healthy business.

Incorrect VAT Rates: Applying the wrong VAT rate to your products is a common issue. Always double-check the current rates for each country you are selling into, as they can frequently change.

Poor Record-Keeping: Incorrect or incomplete records can lead to discrepancies in VAT returns. Ensure all transactions are recorded accurately and stored securely.

Late VAT Registration: Registering for VAT late can result in penalties. Keep track of your sales thresholds and register as soon as you surpass them.

Failure to File on Time: Missing the deadline for filing your VAT returns can also lead to hefty fines. Set reminders to ensure you never miss a deadline.

Incorrectly Classified Goods: Misclassifying goods can result in incorrect VAT charges. Make sure all products are correctly categorized according to their corresponding VAT rates.

Ignoring International Rules: Different countries have varied rules for VAT. Ensure you understand and comply with the VAT regulations of each country you are operating in.

Not Accounting for Reverse Charge: The reverse charge mechanism can be complex, but failing to account for it can result in compliance issues. Make sure you understand when and how it applies.

By addressing these common mistakes, you can better manage your VAT responsibilities and avoid potential penalties.

Integrating VAT with Amazon Seller Central

Integrating VAT with Amazon Seller Central requires precise attention to detail. Start by navigating to the Seller Central dashboard. Go to the Settings menu, and under the Tax Settings, select VAT Calculation Service.

Activate VAT Calculation Service

Follow the on-screen instructions to activate the service. Ensure that your business information, such as the company name, address, and VAT identification number, are accurate and up to date. Once activated, the VAT Calculation Service will automatically calculate and add VAT to your orders based on the customer’s location and the nature of the goods sold.

Configuring Product Tax Codes

Next, set up your Product Tax Codes (PTCs) for your inventory. This can be done through the Manage Inventory page where you can apply the appropriate VAT rate for each product category. Be precise with your selection as different products may attract different VAT rates.

Managing VAT invoices

Amazon allows you to generate VAT invoices automatically. To do this, go to the Tax Report Settings section and choose the option to Generate VAT Invoices. This will help you in maintaining compliance and ensuring that your customers receive proper documentation for their purchases.

After these integrations, it’s crucial to regularly monitor your VAT transactions and reports. Use the VAT Transactions Report and the VAT Calculation Report found in the Reports section of Seller Central to review calculated VAT amounts, returns, and remittances.

Benefits of VAT Compliance

VAT compliance brings numerous advantages to Amazon sellers. Firstly, it helps in gaining customer trust by adhering to taxation laws. This transparency can enhance your reputation among consumers and increase sales.

Compliance ensures avoiding legal penalties, such as fines or business shutdowns, which can arise from non-compliance with tax regulations. Maintaining proper records and timely filing VAT returns can safeguard your business from such risks.

Another benefit is the potential for input tax credits. Sellers can often claim credits for VAT paid on business expenses, reducing overall tax liability and improving profitability.

VAT compliance can also aid in international expansion. Complying with VAT regulations makes it easier to operate in multiple countries, ensuring smooth cross-border transactions and broadening your market reach.

Choosing the Right VAT Service Provider

Choosing the right Value Added Tax (VAT) service provider is crucial for Amazon sellers aiming to maintain compliance and efficiency in their operations. The complexities of VAT regulations across different countries make it essential to partner with a knowledgeable and reliable provider. Here are key considerations for selecting a VAT service provider:

Expertise in E-commerce and Cross-Border VAT

A provider with specific experience in e-commerce and cross-border VAT issues can offer tailored solutions for Amazon sellers. They should understand the nuances of international sales and the implications of various VAT regulations.

Comprehensive Services

Look for a provider that offers a full suite of services, including VAT registration, compliance, filing, and advisory services. This ensures all VAT-related needs are handled under one roof, simplifying the process for sellers.

Automation and Integration

An ideal VAT service provider should offer automated tools that integrate seamlessly with Amazon Seller Central. Automation helps reduce errors, save time, and streamline the VAT management process.

Reputation and Reviews

Research the provider’s reputation by checking reviews and case studies. Positive feedback from other Amazon sellers can be an indicator of reliability and effectiveness in handling VAT requirements.

Cost-Effectiveness

While it’s important to find a cost-effective solution, the cheapest option may not always be the best. Balance the cost with the quality of service to ensure that VAT compliance does not become a liability.

Customer Support

Responsive and knowledgeable customer support is essential. The provider should offer assistance in multiple languages and time zones, reflecting the global nature of e-commerce.

By considering these factors, Amazon sellers can make an informed decision when choosing a VAT service provider, ensuring seamless compliance and more focus on growing their business.